5 Common Mistakes When Purchasing Precious Metals

Investing in precious metals is a time-honored strategy for preserving wealth and diversifying your portfolio. However, it’s not without its pitfalls. To make the most of your investment, you must avoid the common mistakes that many newcomers make. In this article, we dive into the five most frequent errors when purchasing precious metals, and provide you with tips on how to sidestep them. Let’s get started!

The Fascinating World of Gold Mining and Production

Gold, a shimmering, precious metal that has captivated human civilization for millennia, is the subject of an intricate and multifaceted industry. From its historical allure to the modern mining methods, refining processes, and ethical considerations, gold mining and production form a captivating narrative. In this article, we will delve deep into the enchanting world of gold, exploring its rich history, the technologies that extract it from the Earth, the environmental and ethical challenges, and the promising future of this timeless treasure.

Why is Gold Important to Own?

In a world of ever-changing financial landscapes, one investment has stood the test of time – gold. For centuries, gold has been coveted for its intrinsic value and stability. In this blog post, we will delve into the reasons why gold is important to own, exploring its historical significance, role as a hedge against economic uncertainties, and its place in a diversified investment portfolio.

Gold: 10 Key Strategies for Maximizing Returns

Investing in precious metals like gold has always been a popular way to diversify portfolios and protect wealth. Its enduring value has made it a timeless asset for investors. However, to maximize gold returns, you need to employ some key strategies that may not be immediately apparent. In this article, we’ll explore ten strategies that seasoned investors wish they had learned sooner when it comes to maximizing gold returns.

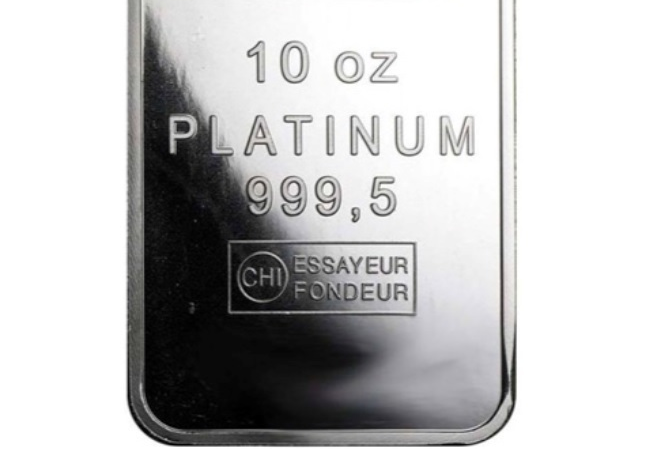

How to Invest in Platinum Bullion and Coins

Platinum, often dubbed the “rich man’s gold,” has been a symbol of luxury and wealth for centuries. But beyond its use in jewelry and industrial applications, platinum offers a unique investment opportunity. With its rarity and diverse applications, it’s no wonder savvy investors are turning their attention to platinum bullion and coins. If you’ve been considering diversifying your investment portfolio, this guide will walk you through the ins and outs of investing in this precious metal.

How to Diversify a Portfolio for Retirement

Retirement. It’s that golden phase we all look forward to, where the hustle of the daily grind takes a backseat, and life’s simple pleasures come to the forefront. But to truly enjoy this phase, one needs to be financially prepared. And the key to that preparation? Diversifying your retirement portfolio.

How to Invest in Precious Metals: Buyers Guide

Did you know that precious metals are actually rare, naturally occurring metallic elements? They hold a lot of economic value and include gold, silver, platinum, and even palladium. People love these metals because they’re super rare, easy to shape, and they don’t corrode easily.

How to Transfer Your IRA into a Precious Metals IRA

Before we dive into the nitty-gritty of transferring your Individual Retirement Account (IRA) to a Gold IRA, it’s crucial to understand what these terms mean. An IRA is a great way to save for retirement. It’s a tax-advantaged investing tool that individuals use to set aside funds for their future. There are several types of IRAs, including traditional IRAs, Roth IRAs, SIMPLE IRAs, and SEP IRAs.

Gold & Silver Price Dumping? Here’s Why! PLUS, MORE!

@TheFloridaStacker shares why price is dropping, discusses buying opportunities, and shows the silver coins that he loves to own when spot price is falling. MetalsMint gets a special shoutout at 3m15s into the video. Watch it below!

5 Best Benefits of Gold IRA

Investing in a Gold Individual Retirement Account (IRA) can seem like a daunting prospect. With so many investment options available, why should you consider gold? Well, the answer is simple. Gold has been a symbol of wealth and a store of value for thousands of years. It’s a tangible asset that has consistently held its value, even in times of economic uncertainty.